Is Black Friday discounting still a big deal?

Reward

Black Friday is less than a month away, with many retailers having set their plans months in advance. But against a backdrop of a constantly changing macro-economic environment, the question of price discounts as a valid tactic is a hot topic. Would retailers be better advised to protect margins rather than sales volumes?

Black Friday is a hugely popular sales period, with over 300 popular, non-food retail brands such as Currys, Nike, Argos and Waterstones taking part last year. Sales on Black Friday weekend have been growing considerably over the last decade but plateaued somewhat in recent years. Rather than an all-or-nothing approach on one day, we're seeing Cyber Monday become more important and retailers begin their promotions earlier in the month, resulting in a 10.4% drop in the share of November sales coming on Black Friday weekend (when comparing 2021 vs 2017).

Go for deals

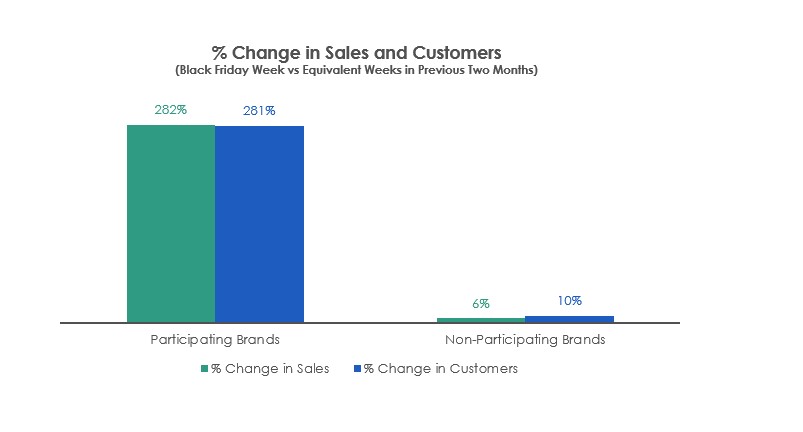

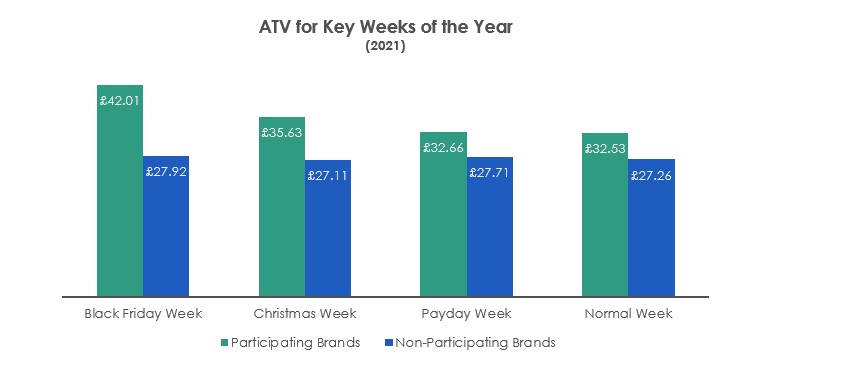

With an average sales increase of 282% during Black Friday week, when compared to equivalent weeks in the prior two months, the allure of participating in Black Friday is obvious. This uplift is primarily driven by incremental customers shopping with the brand. Average transaction values (ATVs) are also 30% higher than a normal week during Black Friday, and non-participating brands see very little sales increase by comparison, so investing in big price discounts is a no brainer.

Average transaction values (ATVs) are also 30% higher than a normal week during Black Friday, and non-participating brands see very little sales increase by comparison, so investing in big price discounts is a no brainer.

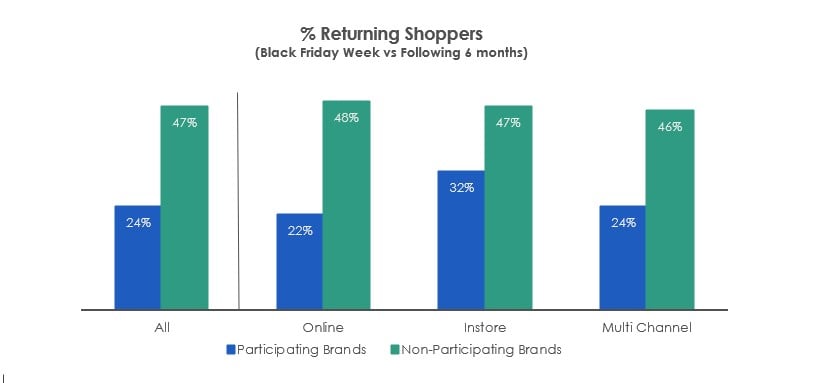

However, it's not that straightforward, the nature of pricing economics means that a 50% reduction in price often requires 3-4 times increase in sales volume to break even, so a 300% uplift may not be all that profitable. Further to that, it may not be worthwhile even as a loss-leader; customers who purchase Black Friday deals are only half as likely to return to that retailer in the next six months than those that purchased from non-participating retailers.

Couple all that with the additional marketing investment required to capture your fair share of Black Friday traffic, and the numbers may not stack up.

It all depends…

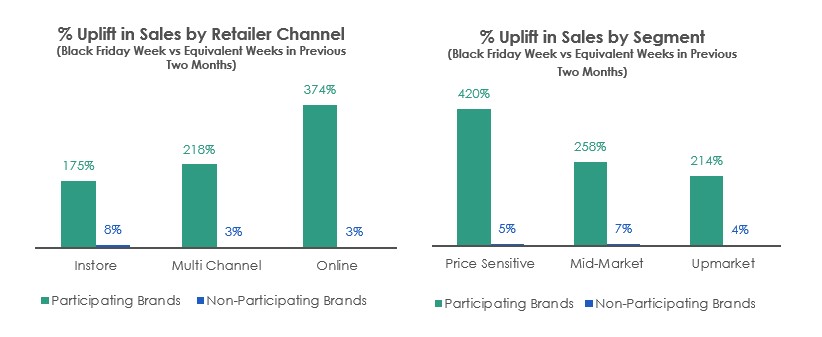

As ever, the reality lies somewhere in-between these two conflicting schools of thought. Online only retailers see a far greater uplift than their bricks & mortar counterparts, as do those targeting more price sensitive demographics. Depending on your brand and proposition, participating in Black Friday might be a great idea or it may not quite have the desired effect.

For retailers who continue to discount, keeping methods in mind to attract repeat spend, and avoid consumers falling into the ‘lapsed’ bucket will be beneficial and assist with increasing sales volumes to help balance discounting. A focus on driving loyalty and rewarding customers for repeat purchases, for example, through the use of Personalised Card Linked Offers (PCLO) is something that should be top of mind for retail brands.

For better or worse, many retailers have built a dependency on big sale events as part of a broader pricing strategy and weaning themselves off that drug isn't something that can be done overnight. However, with a recession looming, there's no time like the present to review those strategies. Adopting a healthy dose of scepticism when analysing this year’s results is highly recommended.

To find out more about how Reward can help you shape your marketing activity and achieve your objectives leave us a message in the comment box and we'll get in touch.

Reward

Related Posts

Black Friday - a welcome boost

Reward

Performance was better than expected, despite low expectations set by analysts and the press....