Performance was better than expected, despite low expectations set by analysts and the press. Consumers took advantage of early November deals and switched to shopping instore, buying money-saving items.

Consumers are reining in spending

Sales were impacted by fewer customers and reduced frequency of spend across Black Friday, Cyber Monday and the whole November period. Over Black Friday weekend there were 6.2% less customers and those who did shop were shopping less frequently with 7.2% fewer transactions.

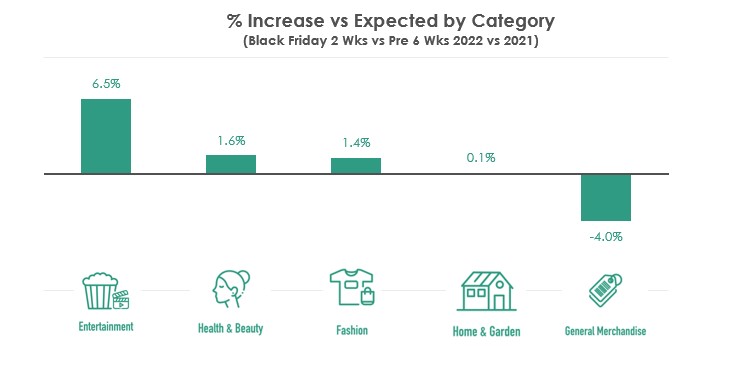

Retailers reported ‘stronger than expected results’

Sales in the last few months have been lower than last year due to the Cost-of-Living crisis. Considered against this backdrop, sales values for most categories show a relative improvement. GM is down vs expected due to the performance of Online Marketplaces.

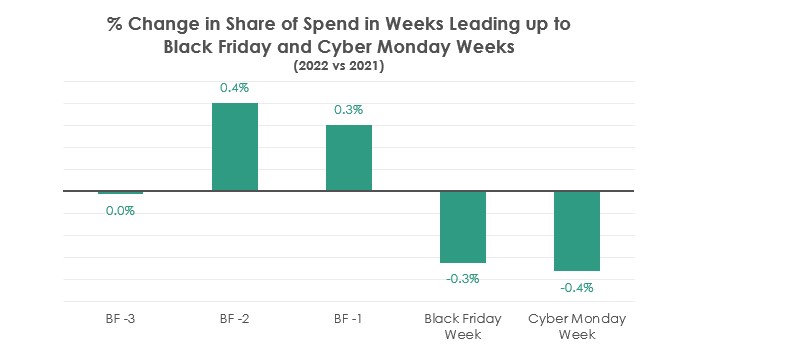

Jumping in early with Black Friday sales

Looking at the whole Black Friday period vs last year, retailers started running promotions earlier in the month. As a result, Black Friday and Cyber Monday accounted for a smaller proportion of the period’s sales than in the previous year.

Compared to last year, 10% of the retailers we tracked saw an increase in the proportion of sales coming in the earlier weeks of November. Spreading promotions over the month seems to be a successful tactic as 77% of these retailers saw an increase in YoY sales. The average YoY % increase over the whole of November for these brands was 75.5%.

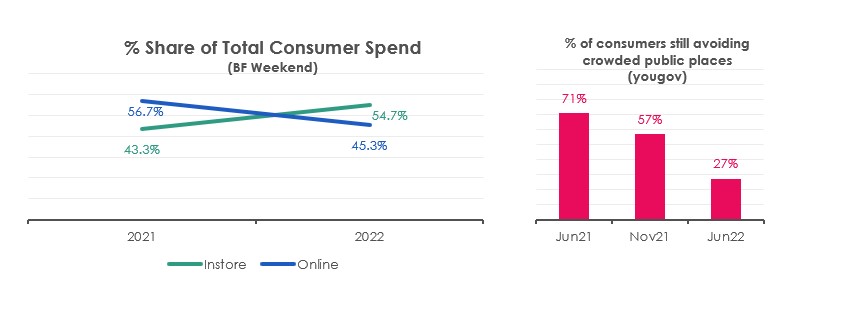

Customers choosing to shop instore

Customers changed their shopping habits this year, as more chose to shop instore than online, the opposite of last year. During the Black Friday weekend spend instore was 11.4% higher than last year, driven by certain categories: General Retail (electronics, books), Health and Beauty (health & nutrition, beauty products), Entertainment (toys & gaming, sports equipment) and Fashion (bags & accessories, baby & childrenswear). Given the nature of these products it would be reasonable to assume that consumers are wanting to see and touch what they buy now that people are no longer avoiding crowded public places as much (Source: yougov).

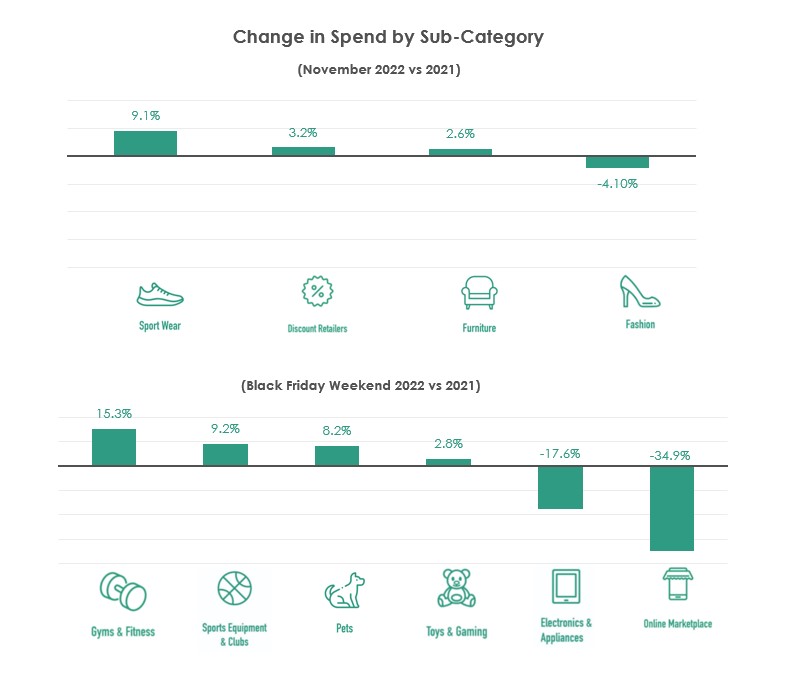

Money-saving purchases were top of the list

With households seeing a rise in mortgage payments, energy bills and food costs, consumers are looking to save money on essential items and forego certain purchases. The squeeze on discretionary spend saw a fall in several fashion sub-categories (mainstream high street, branded high street, bags & accessories) whilst consumers looked to save money shopping at discount retailers. A rise in spend at furniture stores suggests consumers are bringing forward the purchase of big-ticket items in time for welcoming Christmas guests.

During the Black Friday weekend itself, lifestyle services did well (gyms, sports equipment, pets) as did toys, indicating that consumers are spreading the cost of Christmas. Electronics and appliances, normally the ‘go to’ sub-category for Black Friday weekend delivered their lowest sales since 2017 (down 11% in the 6 years). There have been fewer product launches this year so there is no urgency for consumers to spend (Source: GfK 05/12/2022).

What does this mean for Christmas?

UK consumers are tightening their belts in the run up to the festive period. As we have seen, retailers are starting sales earlier, supporting shoppers who are managing their budget this Christmas.

Will we return to a full price December and if so, will it be hard to wean shoppers off promotions? For retailers who continue to discount, an extended period of promotion heading into Christmas could affect Boxing Day and New Year sales and consumers may start to suffer from ‘sales fatigue’. In today’s economic climate, retail brands should look to focus on driving loyalty and rewarding customers for repeat purchases through the use of Personalised Card Linked Offers (PCLO).

To find out more about how Reward can help shape your marketing activity and achieve your objectives, leave us a message in the comment box below and we'll be in touch.