As UK fashion sales continue to suffer, are retailers prioritising budgets over investment in brand perception and a fully integrated shopping experience?

Fashion demand in decline

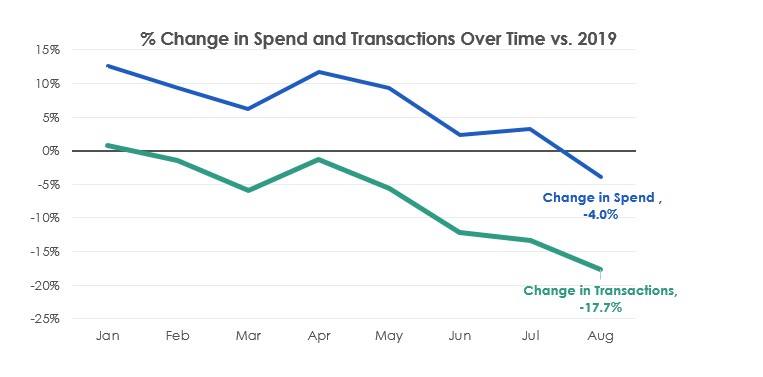

The new year may have started with feelings of optimism towards a post-pandemic recovery for the fashion industry, however due to the cost-of-living crisis, demand for fashion retail has been in consistent decline relative to pre-pandemic levels, consumers are seeking to consolidate their spend and prioritise other categories, such as travel & hospitality.

The difference in spend is less pronounced, as increasing supply chain costs have been passed on to consumers, with prices around 7.5% higher than in 2019(1). Compared to last year, sales were down 15% in August, meaning there’s still 85% of a £58 billion industry still to be won. So, what are some of the considerations for fashion retailers to consider when trying to win their share of the market?

Lessons to be learned from Luxury brands

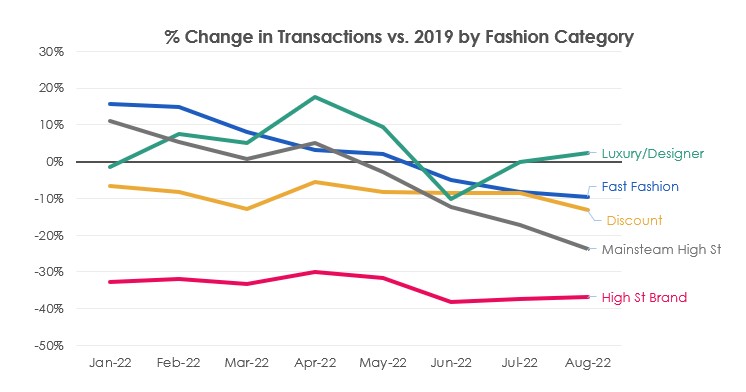

Not all sub-sectors have been impacted equally, some sub-sectors and retailers are seemingly more resilient to the crisis than others, in particular, luxury brands.

Clearly, the more affluent consumers that are targeted by luxury brands are more insulated to inflation, but this also highlights the importance of investing in brand & value perception, allowing you to charge higher prices without compromising market share. Brands that regularly run promotional sales and discounts may find that customers increasingly hold back their purchases until these events come around.

The approach to pricing for fashion retailers may be the most important aspect of planning for a successful Q4, with the decision on what extent they plan to participate in Black Friday and how deep the discounts might go, are central to that.

Discounting during a recession

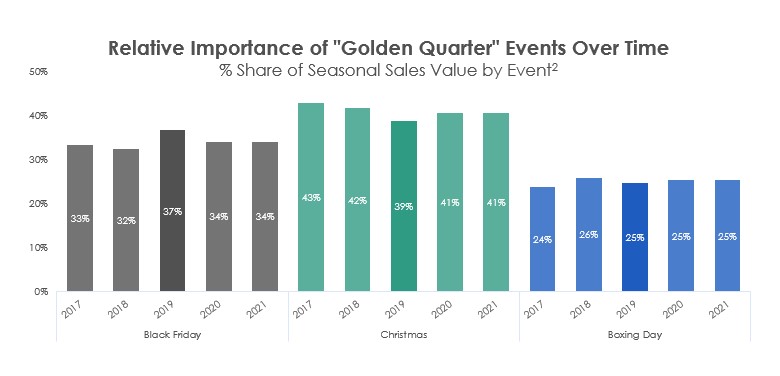

The relative importance of Black Friday to retailers and consumers has been gradually increasing over the last decade since UK retailers first adopted the American event in 2010; in 2019, the fashion sales generated during Black Friday week were nearly equivalent to that in the week before Christmas.

During the pandemic consumers appeared to potentially forego discounted purchases and shifted focus back to Christmas.

This year, amid the cost-of-living crisis the key question is, will consumers hold-off on spending and seek to find better deals during Black Friday and January sales or make more last-minute decisions based on what budget they have left at Christmas? Or will they avoid certain purchases altogether? Understanding your customers’ purchase intent and motivations will be crucial.

The tactical decisions around Black Friday discounting will hinge on the existing positioning and perceptions of your brand. If customers expect offers and low prices, they’ll expect you to participate. For more premium brands, it may be more prudent to focus on using other channels and tactics to acquire customers, grow market share and protect margins.

Online sales growth has stalled

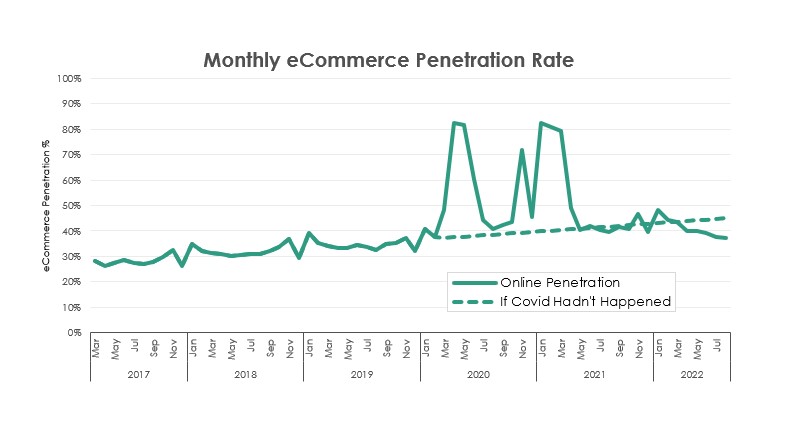

As well as understanding when customers will buy, it’s important to know where customers will buy. Since in-store retailing fully re-opened last summer, eCommerce penetration has been regressing to pre-pandemic levels. The online penetration rate has even dipped below where we could’ve reasonably expected it to be had the pandemic not happened.

This has a significant bearing on how retailers might allocate their advertising budgets, trying to balance the need to capture online traffic with driving in-store footfall. Advertising channels that are equally adept at driving footfall and online traffic would be a shrewd investment this season.

Continue investing, or get left behind.

We have seen demand for some fashion sectors drop as customers seek to navigate the cost-of-living crisis. The announcement in early September that household energy pries will be frozen for two years has been offset by new concerns about rising interest rates, so it remains to be seen whether demand can bounce back at Christmas.

With demand in decline as we approach the ‘Golden Quarter’, there may be some temptation to reduce budgets, but this just makes it easier for competitors to steal market share. During a recession, those brands that continue to invest in maximising mental and physical availability emerge stronger. With a considered and targeted approach to brand, price and discounting, brave retailers can still protect margins and grow market share to ensure they’re on Santa’s nice list come Christmas morning.

Appendix:

- Source ONS, CPI – Clothing & Footwear

- Black Friday = 8 days leading to Cyber Monday. Christmas = 8 days leading to Christmas Eve. Boxing Day = 8 days following Boxing Day (inclusive).