Consumers are more and more turning to the German discount supermarkets, Aldi and Lidl, as a way to save money on their weekly food shop, due to the cost-of-living crisis. Reward’s payments dataset of over 10M UK cardholders allows us to track how consumers are switching their grocery shopping habits.

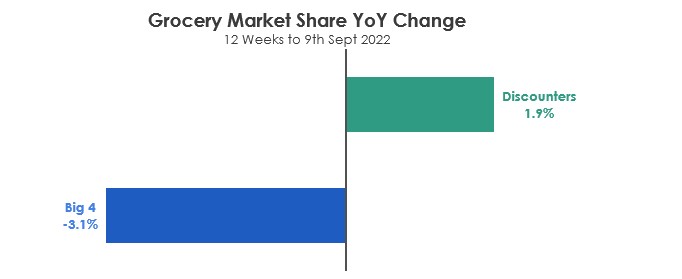

The discounters saw their rapid market share growth plateau for a few years from 2019 but, as per the below chart, have stolen significant market share in the last 12 months from the traditional “Big 4” grocers, Tesco, Sainsbury's, Asda and Morrisons.

Despite food inflation rates being around 13%, the size of grocery shopping sales is very similar to last year, with total spend changing by just -0.2% in the 12 weeks to 9th Sept, compared to the same period last year. Discounters’ revenues grew 13%, whilst Big 4 revenues declined by -4.8%. Discounters’ sales growth has come predominantly from a 9% increase in customer penetration.

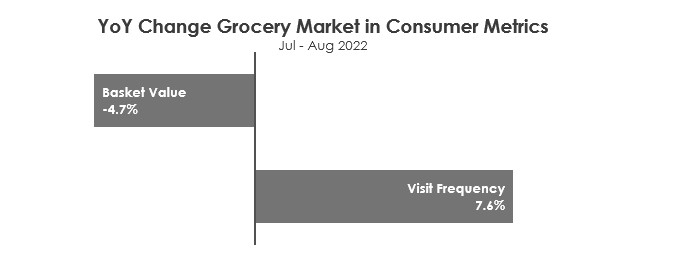

Changing Shopping Patterns

This has coincided with a shift in shopping patterns, with consumers making more, smaller shopping trips. Customer penetration for the Big 4 has remained the same, but average basket value has declined by 7% as customers spread their spend across more stores in a bid to save money. For those who have the time to do so, shopping around allows customers to hunt for the best offers and complete different shopping missions in the most cost effective way.

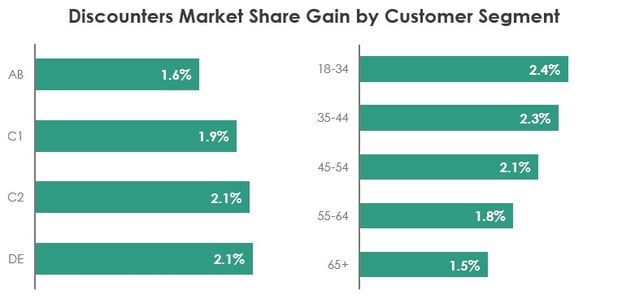

Winning with Younger Consumers

It’s unsurprising that these market share gains are more prominent amongst less affluent customer segments, who are disproportionately affected by current inflation rates. They are also more prominent amongst younger demographics, who are more likely to spread their shopping over more and smaller trips, and multiple brands.

Which all begs the question, what can the Big 4 do to counter this renewed surge?

They’ve spent the last decade implementing, to differing levels of success, new propositions such as price matching and new store formats to help compete. But as inflation continues to bite hard, customers are increasingly drawn to the Discounters low-cost offering. The traditional Big 4 would be better advised to stick to their strengths e.g., broader product ranges, own-label innovation, omni-channel delivery & collection options and rewarding loyalty schemes, rather than try to compete on price, but even that may not be enough to stop the relentless march of the German duo.

To find out more about how Reward can help you shape your marketing activity and achieve your objectives leave us a message in the comment box and we'll get in touch.