Black Friday - a welcome boost

Performance was better than expected, despite low expectations set by analysts and the press....

Changing Plans

Retail marketers are currently having their plans and budgets reviewed, revised or ripped-up altogether, as the cost-of-living crisis and impending recession cause customer demand to decline and supply-chain costs to increase. Many marketers are assessing how to balance customer acquisition with loyalty and retention efforts. In times of economic downturn these tactics are looked at in a different light. Loyalty and retention channels are often lower cost, with a greater reliance on owned, rather than paid, media. In recent weeks, we’ve seen McDonald’s CEO attribute sales growth to their new rewards scheme. On the flip side, ASOS CEO has referenced their brand marketing’s inability to drive customer acquisition as a reason for disappointing sales.

New or Existing, Big or Small?

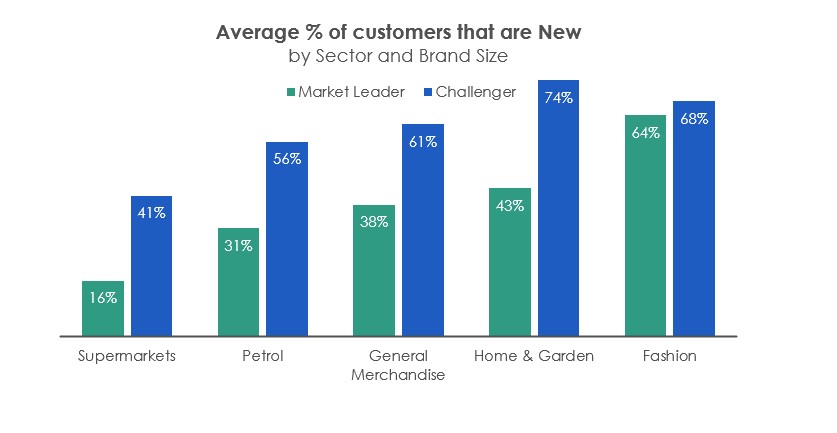

Getting the balance right between customer acquisition and retention may be the difference between success or failure during the challenging economic times we’re facing now and into next year. So, what’s the best approach? The relative value of new and existing customers differs depending on your type of business; larger, market-leading retailers tend to benefit from higher levels of retention (59% of customers purchased in the last year) thanks to their superior mental and physical availability, whereas smaller, challenger brands see a greater churn in their customer base each year1; on average 69% of customers are newly acquired for challenger brands. Different sectors also see varying degrees of loyalty; higher frequency categories such as Supermarkets (65% of customers are existing) and Petrol (58% existing) see more returning customers in a 12-month period, whereas occasional purchase categories like Fashion (66% new customers) are more reliant on activating new and lapsed customers.

Not all Existing Customers are Equal

Not all Existing Customers are Equal

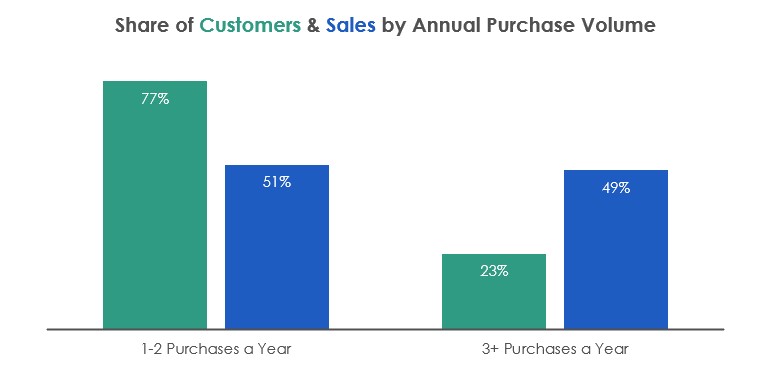

Deciding to focus on existing customers isn’t as straight forward as it may seem. Regardless of sector or brand size, all retailers see a great variety in purchase frequency amongst their existing customer bases. The classic “80-20 rule” typically states that the top 20% of customers drive 80% of sales, and there’s some truth to this. For most non-food retail brands, it’s actually the “50-20” rule, with the top 20% of customers driving nearly 50% of sales.

Looking at the above chart, it can tempting to heavily focus on the low-hanging fruit of the 23% who purchase more than 3 times a year, given the likely efficiency and yield associated with targeting them, but ignore the other 77% at your peril. These customers have a fleeting and infrequent relationship with your brand and they’re unlikely to be subscribed to your emails or follow you on social media. If you fail to reach them, they could easily take those 1 or 2 purchases to a competitor, creating a massive hole in your sales target.

Is Loyalty Even a Thing?

Whilst marketers enjoy the thought of customers loving and advocating their brand, in most cases this is very rare. For non-food retailers, even their most loyal customers are prone to churn; 21% of customers who purchase from a brand 6 or more times in a given year (the top 10% most frequent) won’t come back at all the next year.

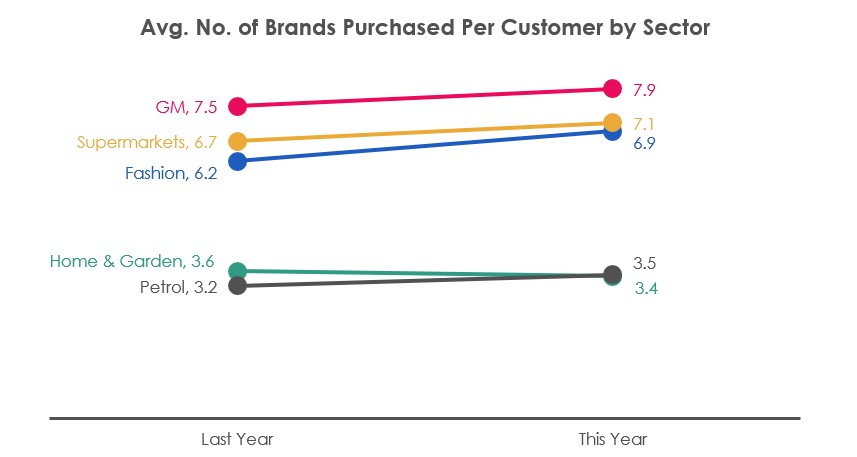

Regardless of loyalty, most customers are likely to purchase multiple brands in the same category. The number of brands each customer purchases in a given category is actually increasing, as customers expand their repertoire in an attempt to get the best deal and save money. With the exception of Home & Garden all other retail sectors have seen an increase in the average number of brands purchased, with fashion seeing the biggest increase, up 11% vs. last year.

Just Focus on Customers

Looking over a three-year period, most brands only see 15% of their customers purchasing more often than once every 6 months, and 51% only purchase once every 3 years. The idea of customers being new or existing only exists in the mind of marketers, so seeing them as separate and opposing activities is damaging to long-term success. The idea that a customer “belongs” to a brand is fanciful and in the retail world they don’t go on some brave voyage of discovery before taking the plunge to make their first purchase. Instead, you need start thinking of your customers as either heavy or light shoppers with very little emotional attachment to your brand.

Once you’ve adopted this mentality:

To find out more about how Reward can help you shape your marketing activity and achieve your objectives leave us a message in the comment box and we'll get in touch.

Performance was better than expected, despite low expectations set by analysts and the press....

Black Friday is less than a month away, with many retailers having set their plans months in...