To some extent all customers will feel the impact of the of rises in tax and spending cuts and will be worse off next year and this will mean hard times for retailers.

Chancellor Jeremy Hunt unveiled his Autumn Statement detailing £55bn of tax rises and spending cuts. The main areas in which consumers will be most impacted are homeowners paying higher mortgage repayments, higher energy bills and people paying more in tax

Mortgage rates will be the biggest challenge

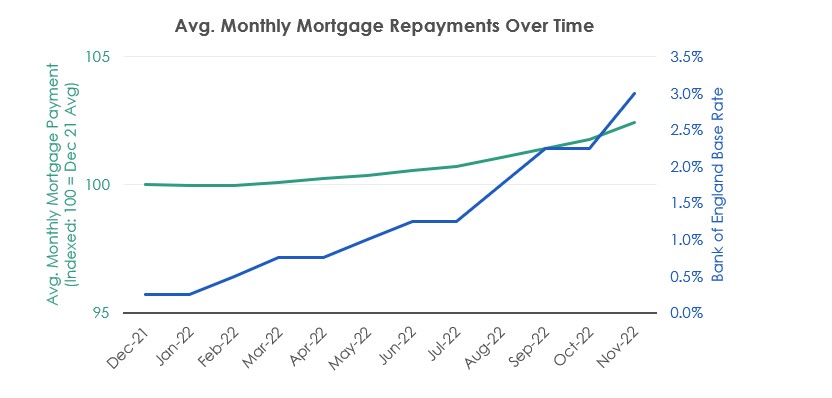

There was no mention of any state support for those struggling to pay their mortgage due to higher interest rates. Average mortgage payments are already up 2.4% vs beginning of the year (a £19 average monthly increase).

15% of homeowners still haven’t seen an impact, so this figure is likely to increase each month for the next 12 months.

Energy bills will continue to wipe out discretionary spend

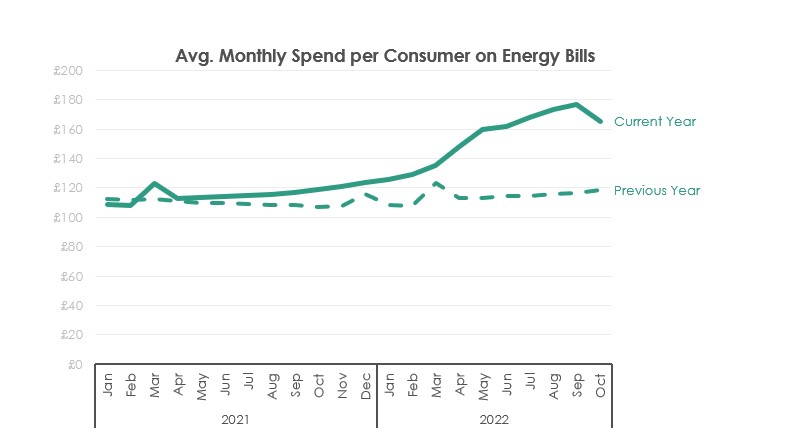

Average energy bills are 39% higher than last year and are expected to grow by a further 56% in the spring, ~£85 per month for a typical household.

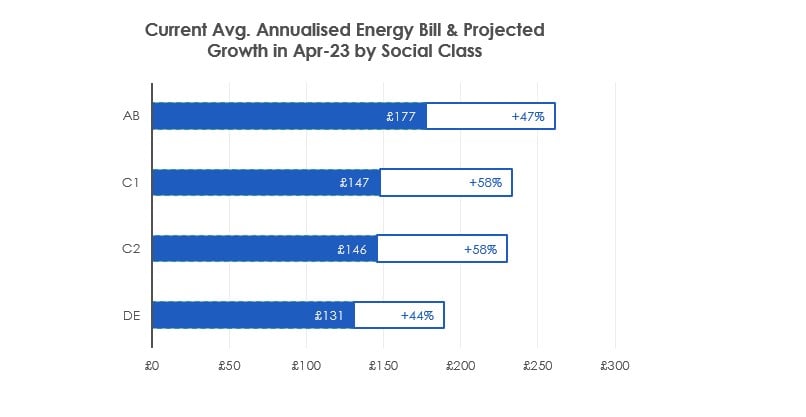

The energy price guarantee is increasing from £2,500 to £3,000 per year for the average household meaning the average household will pay more per month from April 2023. The worst off group are slightly less impacted (+44% increase) thanks to additional means tested support.

Those with the broadest shoulders asked to shoulder responsibility

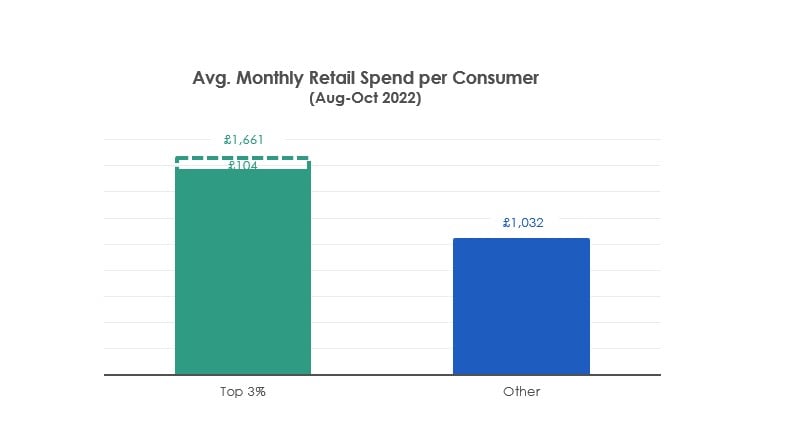

Those who will pay more tax are mostly on higher salaries. Lowering of the 45p tax rate impacts the top 3.6% of the population. This group are disproportionally important to retailers, accounting for 5.7% of total spend.

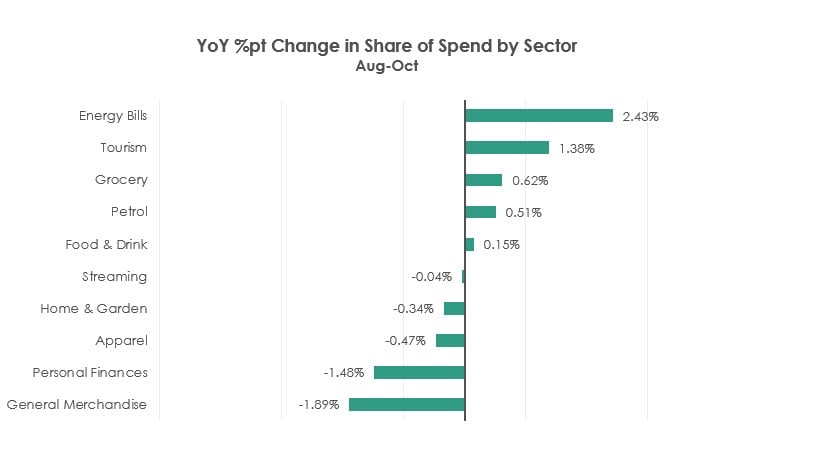

The top 3% of spenders are particularly important to the Tourism, Grocery and Food & Drink categories. We can see where the priorities of these customers lie as they are willing to forego fashion in favour of going on holiday.

Retailers are already feeling the impact and it won’t get any easier

Non-food retail is down 10% vs last year. Grocery retail growth is not keeping up with inflation. Customers are having to prioritise and consolidate their spending choices. With customers likely to have £100s more wiped from their monthly budgets, this will only get worse before it gets better.

To find out more about how Reward can help you shape your marketing activity and achieve your objectives leave us a message in the comment box and we'll get in touch.